Achieving financial freedom can seem like a daunting goal, but with the right strategies and mindset, it’s attainable. The key lies in employing clever earning tactics to build and diversify your income streams, invest wisely, and manage your resources effectively. Here’s a roadmap to help you enhance your earning potential and move closer to financial independence.

1. Diversify Your Income Streams

Relying on a single source of income can be risky. To create a more secure financial foundation, diversify your income streams. Start by exploring side hustles that fit your skills and interests. Freelancing opportunities in areas such as writing, graphic design, or software development can offer additional income while leveraging your existing expertise. Alternatively, gig economy jobs like ridesharing or food delivery can provide flexible earning options.

Consider creating passive income streams as well. Investments in stocks, bonds, or real estate can generate ongoing revenue with minimal day-to-day involvement. For example, rental properties can offer a steady cash flow, and dividend-paying stocks can provide regular income. Look for opportunities that align with your financial goals and risk tolerance, and diversify your investments to reduce risk.

2. Invest in Yourself

Investing in your personal and professional development can significantly boost your earning potential. By enhancing your skills and knowledge, you position yourself for better job opportunities and career advancement. Pursue certifications, attend workshops, or enroll in online courses relevant to your industry. These investments can lead to higher-paying roles and open doors to new career paths.

Networking is another crucial aspect of career growth. Building relationships with industry professionals can lead to new opportunities and valuable insights. Attend industry conferences, join professional associations, and participate in online forums to expand your network and stay updated on trends and opportunities.

Additionally, developing soft skills like communication, leadership, and problem-solving can make you more attractive to employers and increase your earning potential. Investing in personal growth not only enhances your career prospects but also boosts your confidence and job satisfaction.

3. Embrace Entrepreneurial Ventures

Entrepreneurship can offer a path to financial freedom by allowing you to create and grow your own business. While starting a business requires careful planning and dedication, it can be highly rewarding. Identify a market need or niche that aligns with your passions and skills, and develop a business plan outlining your goals, target audience, and revenue model.

Leverage technology to scale your entrepreneurial efforts. Online businesses, such as e-commerce stores, digital products, or online courses, can reach a global audience with relatively low overhead costs. Utilize social media and digital marketing strategies to build brand awareness and attract customers.

Approach entrepreneurship with a growth mindset and adaptability. Success may not come immediately, but with persistence and strategic planning, you can build a sustainable business that contributes to your financial freedom.

4. Optimize Your Existing Assets

Maximizing the value of your current assets can also help you achieve financial freedom. For instance, if you own a home, consider renting out a spare room or using it as a short-term vacation rental to generate extra income. This can help offset mortgage expenses and provide additional revenue.

Review your investments and financial accounts to ensure they are optimized. Rebalance your investment portfolio periodically to align with your financial goals and risk tolerance. Look for opportunities to reduce fees and improve returns on your investments.

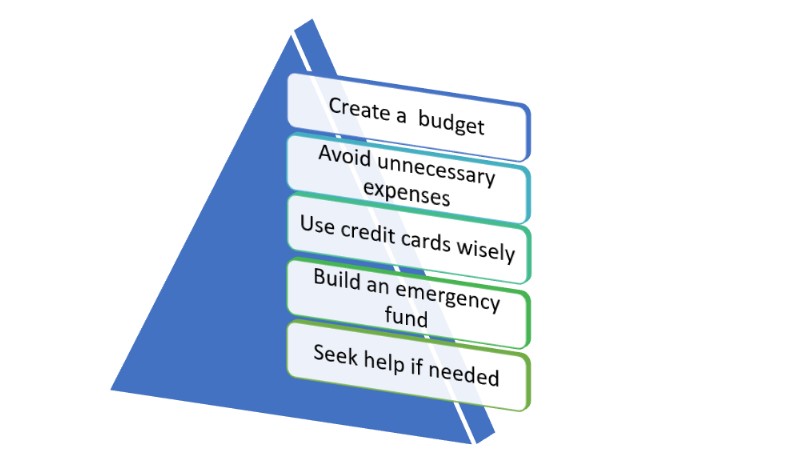

5. Practice Smart Financial Management

Effective financial management is crucial for reaching and maintaining financial freedom. Start by creating a detailed budget that tracks your income, expenses, and savings goals. Identify areas where you can cut costs and redirect those savings toward investments or debt repayment.

Develop a debt repayment strategy to tackle high-interest debt as quickly as possible. Paying down debt not only frees up additional income but also reduces financial stress and improves your credit score. Consider using methods like the avalanche or snowball approach to systematically address outstanding debts.

Additionally, build an emergency fund to cover unexpected expenses. Aim to save three to six months’ worth of living expenses in a liquid, easily accessible account. This financial cushion can provide peace of mind and prevent you from falling into debt during emergencies.

Conclusion

Achieving financial freedom involves a combination of strategic earning tactics, personal development, and effective financial management. By diversifying your income streams, investing in yourself, embracing entrepreneurial ventures, optimizing existing assets, and practicing smart financial management, you can make significant progress toward financial independence. The journey may present challenges, but staying focused on your goals and adapting your strategies will ultimately lead you to a more secure and prosperous financial future.

To Know About Clever Earning Tricks Click Here